Egypt is among the countries most vulnerable to climate change, at risk of acute weather events such as floods, high temperatures, and droughts that will inflict considerable harm to the national economy.

According to its first biennial update report, Egypt emitted around 325,614 Gg of CO2 equivalent in 2015 alone (Egyptian Environmental Affairs Agency, 2018a). The transport sector is the second largest source of greenhouse gas emissions, accounting for 15% of total emissions (EEAA, 2018a), and personal vehicles represent more than 50% of all vehicles in Egypt, most of them in the capital (Moussa, 2023). Air quality in Cairo is thus of particular concern. According to EEAA measurements, the average particulate matter in the air in Tahrir Square, for example, is about three times the acceptable safe limit (2018). In fact, local air pollution is one of the top five causes of premature death in Egypt (Abbass et al., 2021).

Besides the environmental and health problems caused by vehicle emissions, the World Bank estimated that Egypt’s annual CO2 emissions cost the country around USD141.7 million annually (World Bank, 2014).

Despite Egypt’s budding interest in electric vehicles (EVs) as an urgent response to these challenges—as evidenced in the latest Nationally Determined Contributions (Ministry of Environment, 2022)—adoption has been slow. As of 2023, only 3,500–4,000 electric vehicles are in use in the country (El Sawy, 2023).

Throughout this commentary, I discuss the incentives and barriers to EV adoption identified in the literature on EV policy, assess existing policy gaps in Egypt, and recommend policies that overcome obstacles to EV adoption and take advantage of available opportunities.

The literature on EV adoption and incentivization outlines a number of factors that determine the successful transition to EVs, most importantly ownership costs, driving range, charging time, fuel prices, consumer characteristics, charging network, social norms, and public visibility. EV adoption can be bolstered by both financial and non-financial incentives and policies, such as the provision of accessible charging infrastructure and awareness campaigns (Coffman et al., 2017). Green marketing, for example, promotes products that are sustainable or ecologically friendly, and the literature shows that it has a noted positive effect on consumers’ decision to switch to EVs (Mohammed & Shafie, 2021).

Currently, the government is attempting to incentivize the transition to EVs. Ministerial Resolution 255/2018 exempted EVs from customs duties and allowed the import of EVs that are no older than three years. However, as per the General Agreement on Tariffs and Trade (GATT), combustion vehicles produced in the European Union are also eligible for customs-free treatment in Egypt, thereby eliminating any financial advantage for EVs. So what propels Egypt’s strategy if not financial incentives for consumers?

The focus is currently on establishing a local manufacturing base for EVs. The Egyptian government earlier entered negotiations with the Chinese manufacturer Dongfeng Motors, but unfortunately, talks went nowhere. However, a memorandum of understanding was signed last year with another Chinese EV manufacturer, the BAIC group, though it is still uncertain when production will begin (Enterprise, 2022a).

This commentary takes as its starting point a study produced by the Egyptian Cabinet Information and Decision Support Center (IDSC) (2022) to think through the reasons for the low rate of EV adoption in Egypt. Private and published interviews with auto leaders and experts were thematically coded according to the findings of Coffman et al. (2017) on EV incentivization, barriers, and policy in order to make sense of Egypt’s EV policy strategy. This coding aims to clarify and categorize the strategies, directions, and institutions at work.

| Themes | Codes |

| Manufacturing localization |

|

| Infrastructure |

|

| Financial incentives |

|

| Non-financial incentives |

|

| Awareness |

|

| Capacity development |

|

Table 1. EV Adoption Strategies in Egypt

These thematic groups capture the general trends guiding thinking on EV development in Egypt. Around 65% of auto experts, for example, recommended localizing EV manufacturing as the most efficient policy for increasing the popularity of EVs. Infrastructure and financial incentives came in second, with around 30% of those interviewed endorsing this direction. Capacity development was the area of least concern—only 13% of interviewees mentioned it—while, interestingly, non-financial policies were not mentioned at all.

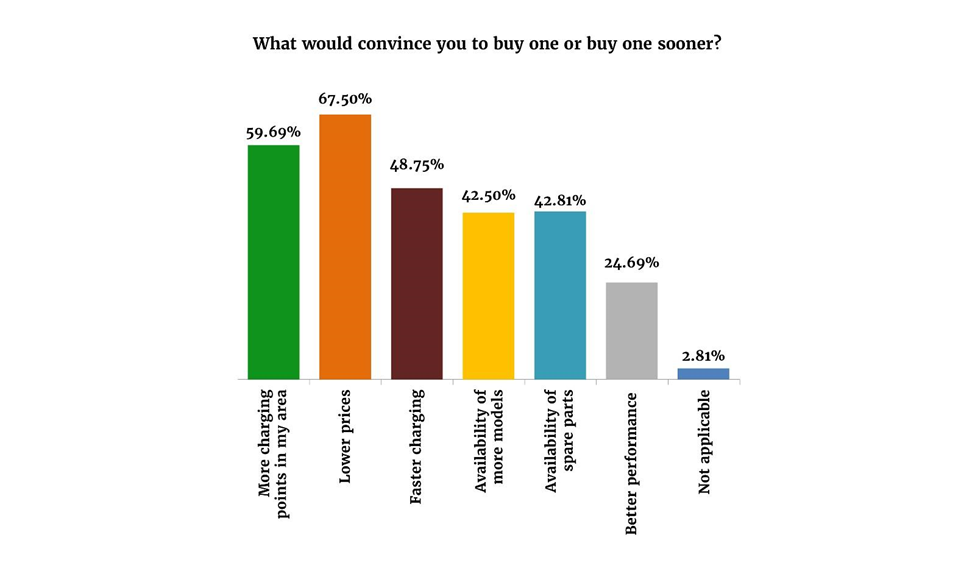

It is clear that EV policy revolves largely around manufacturing, which, according to the findings of the IDSC study, will help to reduce the cost of EVs and create new jobs. But this approach suffers from multiple shortcomings. First, the profits made by localizing EV production will be undercut by the high price of imported expertise and materials (the motor and battery, for example). The lack of options in vehicle models might also be an obstacle, as documented by a survey carried out by Enterprise magazine (2022b) (see Figure 1).

Figure 1. Enterprise Survey: EV Purchase Incentives

The Egyptian government announced that it would additionally offer subsidies of up to EGP50,000 on the purchase of locally manufactured EVs (approximately USD2,500) (Samir, 2022). While this financial incentive is very important, it could also be applied to imported EVs to foster overall market demand.

According to the Enterprise survey participants (Figure 1), infrastructure growth is crucial to increase the adoption of EVs, with nearly 60% of respondents identifying it as key to their decision to buy an EV.

What is yet to be addressed, however, in the government’s plan to increase reliance on EVs are the non-financial policies and incentives that would help create a market. Such policies should aim to increase the public visibility of EVs and foster social norms around EVs as a potential future for Egyptian transportation.

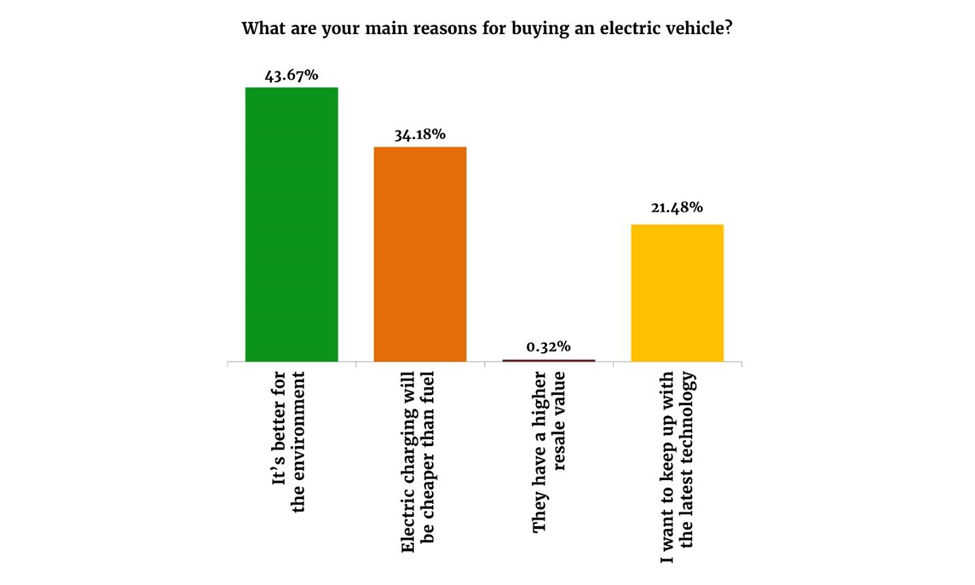

Moreover, non-financial incentives are shown to be very attractive to potential consumers and significantly increase the likelihood of EV adoption (Coffman et al., 2017). This is confirmed by the Enterprise survey (Figure 2). Asked about their main motivation for purchasing an EV, 21.8% of potential customers named the desire to keep up with the latest technology, while 43.6% cited environmental reasons as a sufficient incentive.

Yet, the thematic analysis conducted for this piece found that the current strategy to accelerate EV adoption in Egypt lacks any attention to information and awareness campaigns. According to Kotb and Shamma (2022), educational level and, specifically, environmental knowledge is proven to be significant to the purchase intention of EVs in Egypt.

Figure 2. Enterprise Survey: Main Reasons Driving EV Purchases

Conclusion

The adoption of EVs in Egypt would have several economic, environmental, and health benefits. International experience highlights several effective policies that could be adopted to increase the number of EVs. The Egyptian government’s strategy is currently focused on manufacturing them locally to lower costs while increasing the economic returns. Additionally, it plans to introduce financial incentives only for locally manufactured EVs, to the exclusion of EV imports. This approach has several flaws. First, EVs currently have a negligible market share and are not popular with all customers. Moreover, only one or two EV models will be available, which will not appeal to all potential customers. Finally, government policymakers have neglected two important policy areas: non-financial incentives and information and awareness policies. These oversights help explain why Egypt still has low adoption rates for EVs, despite the considerable market potential and anticipated benefits.

References

- Abbass, R. A., Kumar, P., & El-Gendy, A. (2021). Emissions control scenarios for transport in Greater Cairo. Toxics, 9(11), 285.

- Coffman, M., Bernstein, P., & Wee, S. (2017). Electric vehicles revisited: A review of factors that affect adoption. Transport Reviews, 37(1), 79–93.

- Egyptian Environmental Affairs Agency. (2018a). Egypt’s first biennial update report. Ministry of Environment. https://unfccc.int/sites/default/files/resource/BUR%20Egypt%20EN.pdf?download

- Egyptian Environmental Affairs Agency. (2018b). Monthly air quality report.

- El Sawy, N. (2023, March 1). Chinese EVs drive into Egyptian market with hefty price tag. The National. https://www.thenationalnews.com/business/technology/2023/03/01/chinese-evs-drive-into-egyptian-market-with-hefty-price-tag/

- Enterprise. (2022a, June 14). El Nasr to sign contracts next month with China’s BAIC Group to jointly manufacture EVs in Egypt.https://enterprise.press/stories/2022/06/14/el-nasr-to-sign-contracts-next-month-with-chinas-baic-group-to-jointly-manufacture-evs-in-egypt-73631/

- Enterprise. (2022b, November 1). Interest in electric vehicles is slowly but surely picking up in Egypt. https://enterprise.press/greeneconomys/interest-in-electric-vehicles-is-slowly-but-surely-picking-up-in-egypt/

- Information and Decision Support Center. (2022). Opinions and suggestions: Auto manufacturing (Qadaya wa-Ara’: Sina‘at al-Sayarat).

https://eip.gov.eg/IDSC/Upload/Publication/FullFile_A/5221/%D8%B5%D9%86%D8%A7%D8%B9%D8%A9%20%D8%A7%D9%84%D8%B3%D9%8A%D8%A7%D8%B1%D8%A7%D8%AA.pdf [in Arabic] - Kotb, M., & Shamma, H. (2022). Factors influence the purchase intention of electric vehicles in Egypt. International Journal of Marketing Studies, 14(2), 27–46.

- Ministry of Environment. (2022). Egypt’s first updated nationally determined contributions. Egypt Updated NDC.pdf.pdf (unfccc.int)

- Mohammed, S. T., & Shafie, R. M. (2021). The moderating role of demographic characteristics between green marketing mix of eco-friendly products and customer switching behavior: A case of the Egyptian automobile market. JCES, 12(1), 445–492.

- Moussa, R. R. (2023). Reducing carbon emissions in Egyptian roads through improving the streets quality. Environment, Development and Sustainability, 25, 4765–4786.

- Samir, A. (2022, October 5). Manufacturing EVs: Adopted and subsidized by the state at EGP50,000 per car (Sina’at al-Sayarat al-Kahraba’iya: al-Dawla Tabannatha wa-Da‘amatha bi-50 Alf Junayh li-Kull Sayara) Youm7. https://www.youm7.com/5928885 [in Arabic]

- World Bank. (2014). Cairo traffic congestion study: Executive note.

Reference

https://aps.aucegypt.edu/en/articles/1013/electric-vehicle-adoption-in-egypt-a-long-way-to-go